A Gift Act is a legally binding document that helps with the transfer of ownership of a residential property from one person (benefactor) to another (recipient) without any monetary exchange. This approach of residential property transfer is frequently used among relative and charitable organizations. Nevertheless, to ensure its legitimacy, it should follow specific legal needs, including appropriate documentation and registration.

Legal Framework Governing Present Actions

The Transfer of Property Act, 1882, regulates Gift Acts in India. According to Section 122, a legitimate Present Deed need to entail a voluntary transfer without browbeating, fraud, or excessive impact. The benefactor ought to be lawfully qualified, indicating they need to be of sound mind and above 18 years old. The beneficiary, on the other hand, can be an individual, a legal entity, or a charitable institution.

A Present Act can be carried out for both movable and unmovable properties. While movable assets like cash money, jewelry, and supplies do not need obligatory enrollment, immovable properties such as land, houses, or industrial areas must be registered with the Sub-Registrar’s Office.Read about texas contract for deed walkthrough At website The donee should approve the gift while the benefactor is still alive for the transfer to be legitimately legitimate.

How to Compose and Execute a Gift Act?

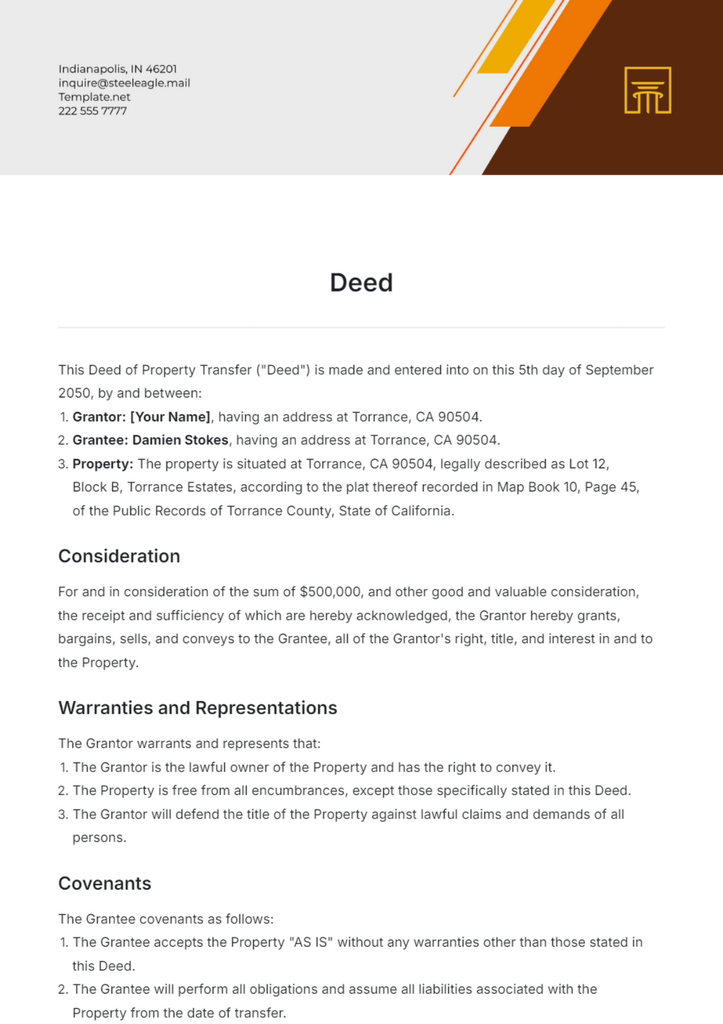

A Gift Act need to include the complying with vital stipulations:

- Information of Benefactor & Recipient – Complete name, address, and relationship (if any type of).

- Summary of the Gifted Residential property – Specific details of the property being gifted.

- Volunteer Nature of the Gift – Confirmation that the benefactor is gifting willingly.

- Approval Stipulation – A statement that the beneficiary has approved the gift.

- Observe Signatures – Two witnesses should authorize the act.

Enrollment of Present Deed

Based on the Registration Act, 1908, a Gift Act for stationary home should be registered at the Sub-Registrar’s Office. Steps for Registration:

- Prepare the Present Action with the help of an attorney.

- Pay Stamp Responsibility (differs by state, normally 2% to 5% of the building value).

- Visit the Sub-Registrar’s Workplace with called for files.

- Authorize the Deed in Presence of the Registrar.

When registered, the beneficiary comes to be the lawful owner of the residential property.

Tax Effects of a Gift Deed

Taxes on gifted building relies on the partnership in between the contributor and recipient. Under Section 56( 2) of the Revenue Tax Obligation Act, 1961, gifts received from defined family members, such as moms and dads, spouse, kids, and siblings, are exempt from tax obligation. Nonetheless, if a gift is received from a non-relative and goes beyond 50,000 in worth, it is dealt with as earnings and is taxed under ‘Earnings from Other Sources.’

An additional important element is Capital Gains Tax Obligation. Although the donor does not pay capital gains tax at the time of gifting, the Recipient comes to be accountable for resources gains tax obligation when they decide to market the talented residential property. The tax obligation is computed based on the initial acquisition expense paid by the benefactor.

Final thought

A Present Act is a protected and legitimately identified technique for moving property without monetary exchange. Nonetheless, appropriate paperwork, enrollment, and tax factors to consider are vital to ensure an easy transfer. Seeking lawful aid can help in drafting a Gift Deed appropriately and staying clear of future disagreements.

If you are taking into consideration gifting home to an enjoyed one, ensure you comply with the legal process faithfully to stay clear of any lawful or economic complications. Consulting a real estate specialist or legal advisor can assist browse the intricacies connected with Gift Acts and make certain a smooth building transfer process.